Following months of intense negotiations, the landmark climate, health care, and tax package called the “Inflation Reduction Act.” is nearing the finish line. And what a victory it will be!

The legislation moved out of the Senate and is expected to pass the House this week. When it does, it will be the largest US climate investment in history with an estimated $370 billion in tax credits, rebates, grants, and loans aimed to dramatically cut emissions.

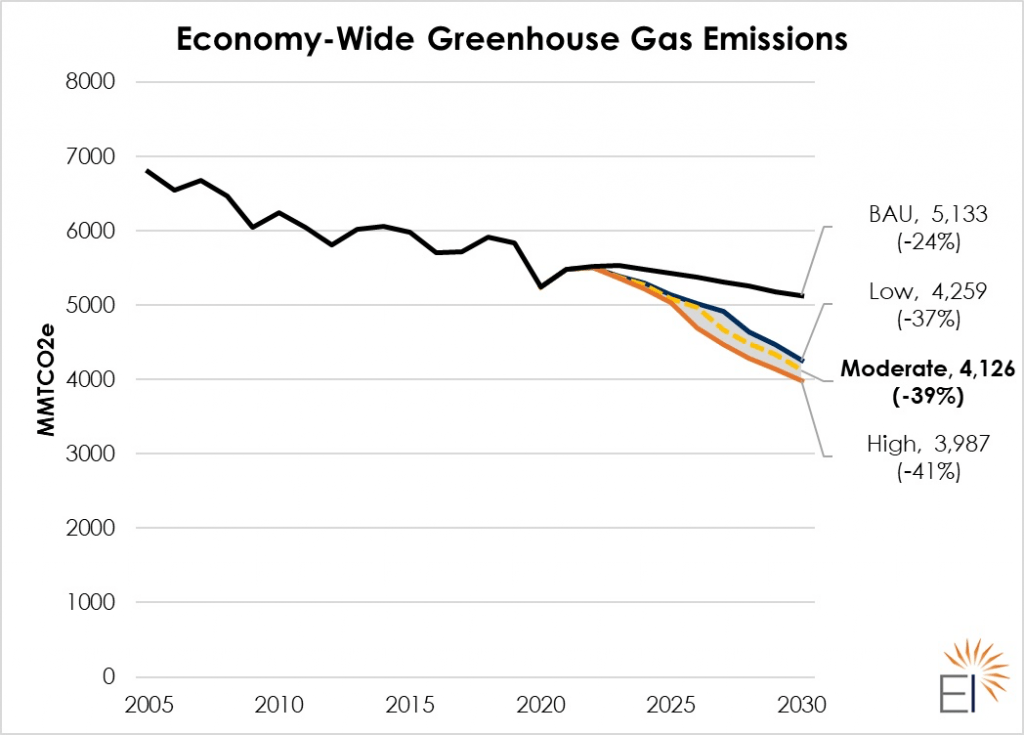

The scale of the Inflation Reduction Act is significant. Three independent analysts have found that the Inflation Reduction Act’s climate and energy provisions would allow the U.S. to reduce its overall emissions by about 40% below 2005 levels by 2030. This would bring the U.S. most of the way to President Biden’s goal of cutting U.S. emissions by 50% below 2005 levels by the end of the decade.

Of particular importance is the package’s deployment of domestic or allied manufacturing of clean energy technology and related minerals. Analysis by Energy Innovation concluded that the legislation would create up to 1.5 million jobs.

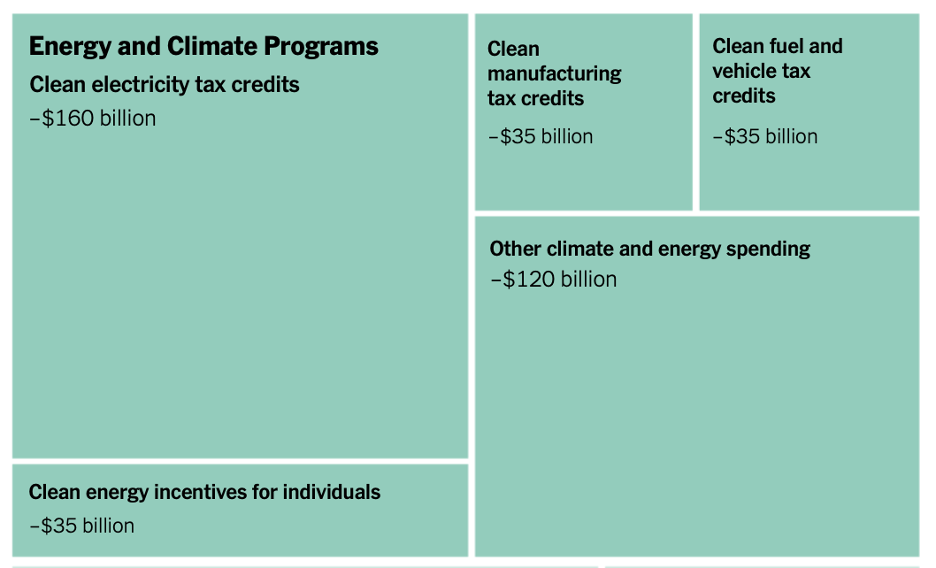

Allocating $370 Billion for the Greatest Impact

Clean Electricity Tax Credits: ~$160 billion

- Extends the production and the investment tax credits for solar, wind, and other renewable energy technologies for 2 years, then modifies both credits to be a technology-neutral, zero-carbon tax credit until 2032

- There are also some significant and important changes to the tax credit that will make it easier for non-profits, co-ops, and other entities who may not have a tax liability to take advantage of the credit

- Allows energy storage systems to qualify for the investment tax credit and to support existing nuclear power plants

- Extends the residential rooftop solar tax credit (25D)

Clean Energy Grants and Incentives: ~$35 billion

- $9 billion for a rebate program for energy efficiency and home electrification for low-income customers to be administered by states

- Extends the 25C residential energy efficiency and solar tax credits (Section 25C)

- Extends important tax credits for residential and commercial tax credits for energy efficiency improvements.

Clean Energy Manufacturing Tax Credits: $35 billion

- New production tax credit to support US-based manufacturing of solar panels, wind turbines, batteries, and critical minerals processing and recycling

- $10 billion investment tax credit to build clean energy manufacturing facilities

- $500 million to support the manufacturing of heat pumps and critical materials through the Defense Production Act

Clean Vehicle Tax Credits and Incentives: $35 billion

- $4,000 used vehicle tax credit for zero-emissions vehicles, which is means tested, can be refundable and applies to the first resale of a vehicle

- Prioritizes affordable electric vehicles as well as low and medium-income consumers by implementing an income cut-off for tax credit recipients

- $7,500 tax credit for new zero-emissions vehicles IF the vehicle’s key battery and other components are manufactured in the U.S. or with countries that the US has a free trade agreement with (also removes the per-manufacturer cap)

- $1 billion grant program to help public entities replace heavy-duty vehicles with zero-emissions vehicles.

- New tax credit for Sustainable Aviation Fuels (lower-carbon fuels): $1.75 per gallon of fuel that reduces aviation emissions by 50% or more

Other Programs of note:

- $27 billion for a national clean energy fund to help start-up state and local clean energy funds, as we have worked on in recent years at Utah Clean Energy

- A significant fee and funding for a “Methane Emissions Reduction Program” to reduce leakage of methane from gas and oil operations, starting at $900 per ton in 2023 and reaching $1500 per ton of methane in 2025. Methane is a potent greenhouse gas.

- $20 billion into agricultural conservation programs that focus on reducing methane emissions, improving soil carbon, and sequestering carbon pollution

- Nearly $10 billion for rural electric cooperatives to invest in zero-emissions electricity options

- $3 billion for new transmission infrastructure and siting.

We expect that there will be a robust discussion about whether the bill would reduce inflation, but the analysis we’ve seen suggests it is likely to have a negligible impact either way.